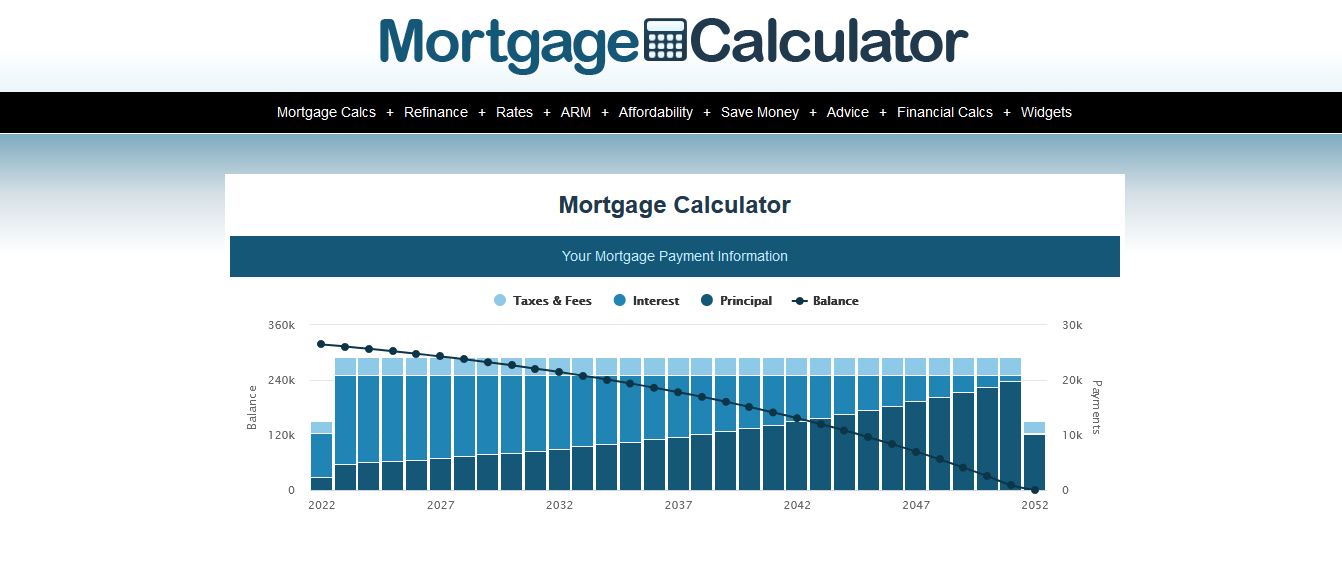

Mortgage Calculator estimates how much of a payment you will need to make each month for your mortgage loan. It uses the information you give us about the home’s price, the interest rate on the loan, the length of the loan, and the amount of the down payment to figure out how much you can expect to pay each month toward the principal and the interest.

Mortgage Calculator also includes the cost of property taxes, mortgage insurance, and homeowners’ fees by using loan limitations and numbers that are determined by your area. As you make payments toward both the principal and the interest on your mortgage, Mortgage Calculator also computes how the number of your loan shifts over the course of the loan’s term.

How to Use Mortgage Calculator in the USA?

The mortgage calculator estimates your monthly payment by taking into account the principle and interest, property taxes, PMI, homeowner’s insurance, and HOA fees. The mortgage calculator also computes the total of all payments made during the amortization term, including the one-time down payment, total PITI, and total HOA fees. The best payment plan is offered to you through a mortgage calculator. Many homeowners want to speed up their loan timeline by making additional payments or biweekly payments.

Here are a few key points to understand the mortgage calculations:

- Your down payment is the difference between the home’s value and the amount. Whether you are renewing the loan or not, you should consider the down payment as equity in your house.

- You should consider the FHFA’s loan restrictions for conventional loans.

- Personal Mortgage Insurance (PMI) is computed only if the down payment is even less than 20% of the home’s worth (i.e., the loan-to-value ratio is more than 80%) and ceases when the outstanding balance (balance) is below or equal to 80% of the home’s value.

- The PMI for 95.01-100 percent LTV is expected to be 1.03 percent, 0.875 percent for 90.01-95 percent LTV, 0.625 percent for 85.01-90 percent LTV, and 0.375 percent for 80.01-85 percent LTV. The amount of PMI you pay is determined by your loan-to-value (LTV), credit score, and debt-to-income (DTI) ratio. Discover how to prevent PMI.

- In the United States, PMI, property taxes, and homeowners’ insurance (also known as hazard insurance or house insurance) are set to national averages.

- These statistics may not be applicable to your own circumstances. If necessary, you may override and input your own estimations.

- Even though you might not pay property taxes or insurance on a monthly basis, they are calculated into the total monthly payment with the premise that you set aside this cash every month (through an escrow/lockup account or some other method).

- Down payment, one-time expenditures, property taxes, and homeowners’ insurance can all be entered as a percentage of the home’s value, and PMI can be entered as a percentage of the balance. If you like, you may also input actual monetary amounts instead.

- Closing fees (including discounted points) and any money that is spent on one-time property repair or remodeling are examples of one-time expenses.

- Bi-weekly payments (also known as’ accelerated bi-weekly, ”True Bi-weekly, ‘or’ bi-weekly applied bi-weekly’) might help you save money on interest and speed mortgage discharge.

- All extra payments shorten the loan term by paying down the principal. You may either print or send a direct link to the mortgage calculator with all of your data pre-filled with friends and relatives.

- Property taxes, PMI, insurance, and HOA fees are included under Taxes, PMI, Insurance, and Fees. The acronym PITI stands for Principal, Interest, Taxes, and Insurance.

The Mortgage Calculations exclude the following expenses and savings:

- Certain ongoing expenses linked with property ownership (e.g., utilities, home warranty, home maintenance costs, etc.)

- Mortgage payment tax deductions are examples of savings.

If you choose an ARM, your mortgage rates (as well as your monthly payment) will fluctuate over time. Some of the regular costs of owning a home will change over time because of changes in the value of the home, inflation, and other factors. Some costs, like property taxes, homeowner’s insurance, and so on, will still be there even after you’ve paid off your loan. All of these things need to be thought about, especially when deciding whether to buy or rent.

FAQ,s – Mortgage Calculator in USA

How long does it take to get a mortgage loan?

Because every mortgage circumstance is unique, it’s difficult to predict how long your exact home mortgage procedure will take. The schedule is affected by things like the type and terms of the home loan you want, the types of documents you need to get the loan, and how long it takes to give those documents to your lender.

Is a home appraisal required to obtain a home loan?

Yes. We will arrange the appraisal as part of the assessment of your home loan application, and you will receive a copy of the assessment at closure.

Can I obtain more money at closing while refinancing my mortgage to pay off other debt?

Yes. If you have enough equity, a cash-out refinance allows you to pay down your existing mortgage(s) while receiving a portion of your mortgage debt in a lump-sum cash payout at closing.

How would my credit score affect the interest rate on my home loan?

Because the way you’ve handled your finances in the past might help anticipate how you’ll handle them in the future, lenders will take your credit rating into account when you apply for a mortgage or other loan. If you have a good credit score, you may be able to qualify for a reduced rate, and some banks may reduce their down payment requirements for a new home loan.

What mortgage repayment options do I have?

There are various options for repaying your home loan. Any checking or savings account can be enrolled in PayPlan. PayPlan will change the amounts that are taken out of your savings account on a regular basis to match any changes that come about because of a contractual payment adjustment.

This service is free of charge. Please keep in mind that PayPlan may not be accessible in all cases, including FHA and VA loans. Follow these simple steps to enroll in PayPlan online:

- Register on Internet Banking for online access, or log in if you’ve already registered.

- Select “Mortgage” from the Accounts Overview page.

What exactly is a mortgage payoff statement?

A mortgage payoff statement itemizes the funds necessary to fully fulfill all obligations guaranteed by the loan which is the topic of the payoff request. Itemizations include the balance of unpaid principal and interest

Will I be charged a payoff statement fee if I have late fees or other penalties levied over the term of the loan?

You or an approved third party will get a payoff statement for free.

When may I anticipate my overage payment?

If you overpaid, your refund cheque will be mailed to you within 20 business days. This guarantees that the funds collected are adequate to cover the entire payoff.

My application for mortgage loan help was denied. Can I appeal that decision?

If you were turned down for home loan help (such as a loan modification, short sale, or deed in lieu), you may be entitled to appeal the decision. You can file an escalated case with us if you think you meet all the criteria for home loan help but were not properly looked at for help or were wrongly turned down for help.

This might include We did not provide you with proper notice of your foreclosure choices. During the loan evaluation process, you were not given enough time to react to our messages. Your loan went into foreclosure too soon, or we didn’t stop the process when we should have.

What is the definition of a mortgage lien release?

A mortgage lien release (also known as a reconveyance deed in some states/territories) is a document delivered by your lender to your local county recorder’s office when your loan is paid off. The lien release says that the person who has a claim on the property is giving up that claim.

When a lien release is not accessible in county records, how can I get one from the bank?

Please wait 90 days after the mortgage has been paid off before contacting the relevant county recorder’s office for a copy.

Best wishes for a mortgage home loan and a wonderful new home!