Individuals and business owners use cloud-based accounting software to track their accounts and record revenue and spending. It is particularly useful for small firms because it is more efficient and produces fewer errors than manual processing. It can also save time because of features like automation, and it provides a secure location for the owner to store crucial Cloud computing impact on accounting and receipts that can be accessed at any time.

Cloud computing’s impact on accounting software is utilized by 64.4 percent of small business owners, which is encouraging given that 60% of small business owners claim to have no financial or accounting skills.1 Read on to find out which accounting software is best for your cloud-based accounting software if accounting isn’t your strong suit, or even if it is and you want to save time.

We looked at over 20 tools and applications to find the best Cloud accounting software UK for small businesses before settling on the top eight. We chose these because they have features and functionalities tailored to small business owners.

What is accounting software?

Cloud accounting Research paper software keeps track of a company’s financial transactions. Instead of being installed locally on corporate computers, online accounting solutions are specifically designed to be utilized through the Internet. This decreases information technology requirements such as server hardware, backups, and maintenance, and shifts the expense from a big one-time capital outlay to a much smaller, but recurring, monthly or annual subscription.

How can Online Accounting Software benefit me at work?

1. Saves time by automatically updating ledgers.

2. Strengthens data security through access safeguards.

3. Offers better Cloud accounting benefits control of your core financial processes.

Pros and Cons of Accounting Software for Businesses

Human error is less likely when accounting software is used. All accounting software is extremely precise (provided you enter the right information).

You’ll be able to save countless hours over the course of your organization’s lifespan if you use business Cloud accounting benefits. Your financial reports are entirely computer-generated.

If your company needs to send invoices to customers, you may use your accounting software to customise and send them. This will help you get paid more quickly!

You won’t have to compute your finances on your own anymore because most accounting software does it for you.

Cloud accounting PDF is particularly handy for keeping track of where your money goes because it has built-in expense tracking.

Cons of Accounting Software for Businesses

An internet connection is essential because many of the accounting software applications are web-based. Even those that aren’t cloud-based require connectivity to the internet from time to time for synchronizing.

Cloud accounting PDF is unlikely to be the ‘be-all and end-all of financial management. Depending on the nature of your firm, you may still require the services of an accountant.

What is the finest self-employed accounting software?

1-800Accountant is the greatest accounting software for self-employed professionals. For busy on-the-go self-employed professionals, 1-800Accountant handles all bookkeeping and accounting. You won’t have to bother about keeping your own books when you use 1-800Accountant.

Is it true that free accounting software is truly free?

Yes, there is truly free accounting software available. Free accounting software is at best minimal, and not everything that is free is worth utilizing, especially when it comes to bookkeeping for businesses. A free trial for online accounting software is also not the same as free accounting software.

What is the finest self-employed accounting software?

1-800Accountant is the greatest accounting software for self-employed professionals. For busy on-the-go self-employed professionals, 1-800Accountant handles all bookkeeping and accounting. You won’t have to bother about keeping your own books when you use 1-800Accountant.

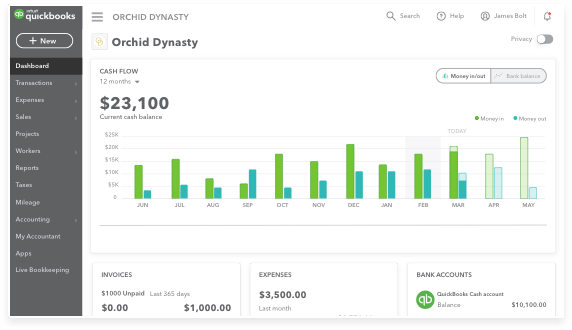

1. Intuit QuickBooks Online

Pricing: Starts at $12.50/month

Intuit Quickbooks might be the first resource that comes to mind when you hear the term, “small business cloud-based accounting software” — and for good reason. Beyond its first-rate suite of capabilities, the program sets itself apart with elements like receipt capture and 24/7 chat support.

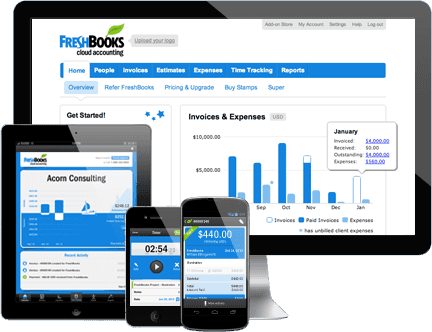

2. FreshBooks

Pricing: Starts at $4.50/month

FreshBooks is a simple solution that prides itself on improving the efficiency of cloud-based accounting software. FreshBooks’ software, according to its website, can help users save up to 46 hours a year on tax filing.

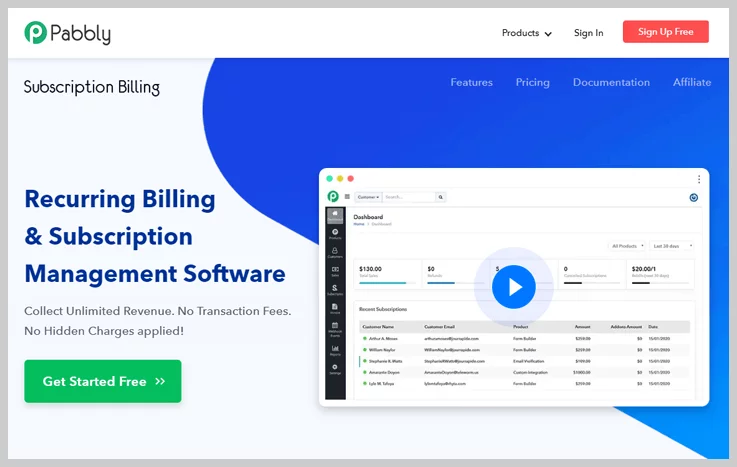

3. Pabbly

Pricing: Starts at $9/month

Pabbly Subscription Billing is a subscription management and recurring billing cloud-based accounting software for small and medium-sized organisations. Monthly payments, revenue, net revenue, active clients, and new subscriptions are all tracked in real time by this software.

4. Sage 50cloud

Pricing: Starts at $340/Year

Sage 50cloud is a suite of accounting and payroll software designed for small and medium businesses by Sage Group. In different regions, Sage offers different items under the Sage 50 brand. The name comes from the UK and Ireland version of the product, where the number 50 signified that it was intended for businesses with up to 50 people.

5. Wave

Pricing: Free — Additional Monthly Cost if You Elect Payroll in Tax Service or the Self-Service States; Some Processing Fees Apply

Wave is a powerful Cloud accounting software UK solution for small businesses and individual contractors. It places significant emphasis on ease of use and synchronicity —letting you link your bank accounts, track your expenses, and balance your books without any trouble. It also lines up with Wave’s additional resources, providing you with an all-in-one solution if you opt to invest in its other products.

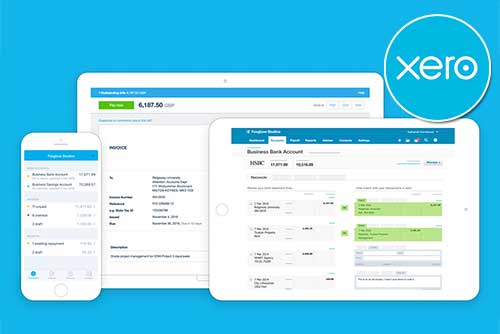

6. Xero

Pricing: Starts at $11/month

Xero lets you get financial cloud-based accounting software good for business reports sent straight to you, and connect your bank account for a seamless experience. If you need payroll services, you’ll have to use them through Xero’s partnership with Gusto. And if you value live support, you should probably look for another provider.

Cloud-Based Solution:

Why cloud accounting is good for business. A cloud-based accounting solution is probably the best option for you. It can take a lot of the weight off your shoulders. It also comes with a slew of benefits and features that will entice you to give it serious thought. You can do the following with a cloud-based accounting solution:

Save money upfront and in the long run.

On a variety of fronts, you can save a significant amount of bandwidth.

Because the solution is online, you may access it from any device.

Take advantage of increased safety.

Not to mention capabilities like collaboration and process automation. If all of that sounds like something you’d benefit from, check out the list of cloud-based accounting software solutions I’ve assembled below.