The US Debt Clock includes every business day by three o’clock in the afternoon, the Public Debt amount that was exemplary at the conclusion of the previous business day is published on the Treasury Direct website in the section titled “Debt to the Penny” by the Bureau of the Public Debt within the United States Department of the Treasury. The system is dependent on reporting bodies, such as Federal Reserve Banks, who submit a range of information regarding Treasury security at the end of each business day.

Worldometer has created an algorithm that, in the time gap between the daily updates provided by the US Treasury, determines the present expected rate of change in the total amount of debt that is outstanding. The formula’s components are updated every day in response to the publication of the most recent official data on the US National Debt. This allows the algorithm to continuously adapt itself in response to the new information. This is obvious that the Debt clock will not provide an exact representation of the current trend. Instead, it will show the debt rising at the latest annualized level, and it will eventually re-adjust suddenly to a lower level.

What is US Debt Clock?

The total amount of the federal government’s outstanding debt is what is referred to as the national debt clock of the United States. It did so for the first time on February 1, 2022, surpassing $30 trillion in value. The current total public debt clock is monitored by the Treasury Department of the United States, and this number is subject to daily modification. In addition to that, the debt clock in New York keeps track of it.

The majority of the country’s debt clock is made up of debt that is held by the general public.

- The federal government is responsible for repaying purchasers of United States Treasury notes, which can include private persons, corporations, and even foreign governments.

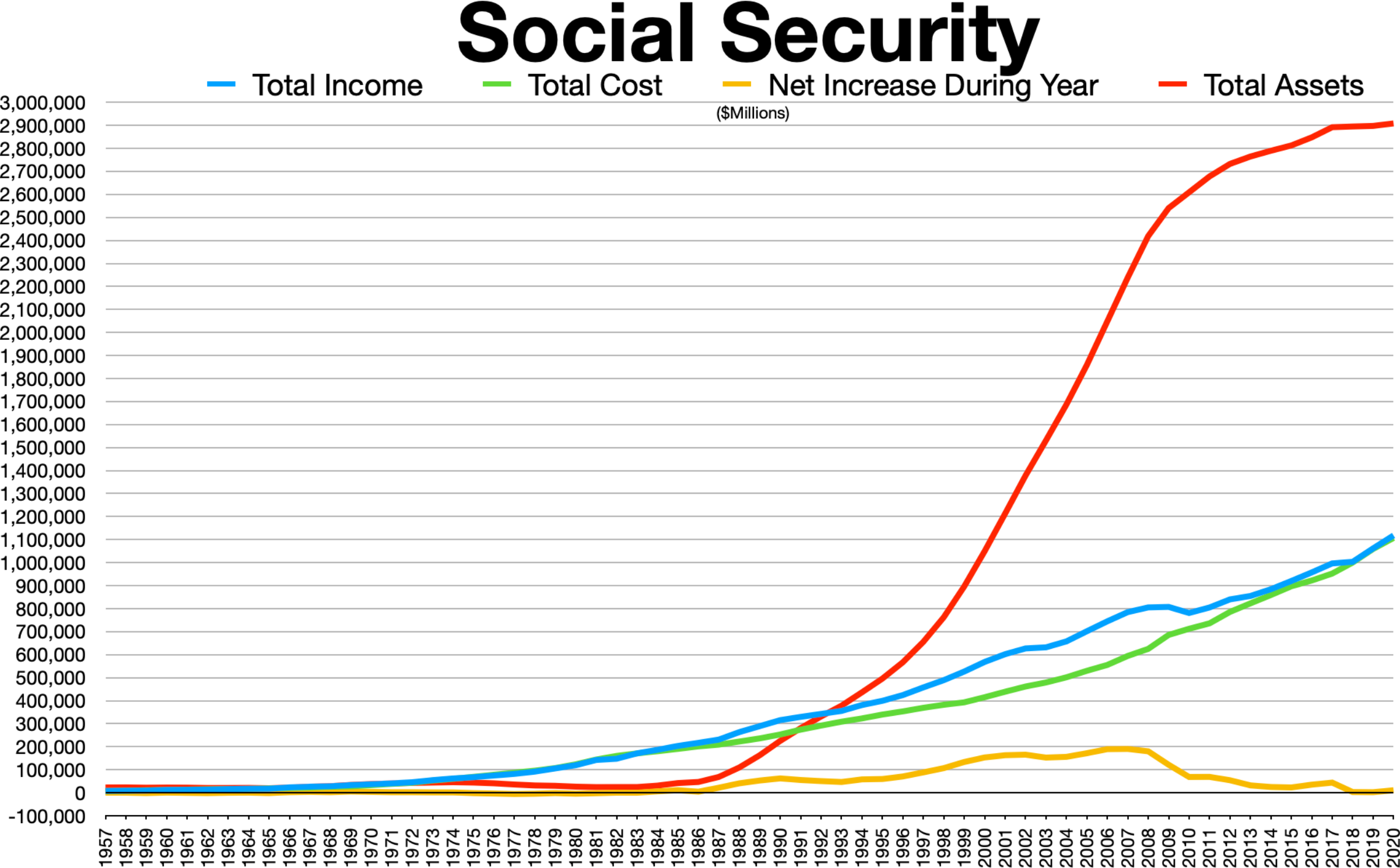

- The remainder is comprised of debt held within the government. This debt is owed by the Treasury to the many departments within the government that own securities from the Government Account Series. The Social Security Trust Fund makes up the largest portion of the ownership.

- The federal government has been running surpluses in these Government Account Series securities for years, and it utilizes those profits to finance other agencies. Over the next twenty years, they will become delinquent as baby boomers (those born between 1946 and 1964) enter their retirement years.

The Increasing Cost of the National Debt in the U.S:

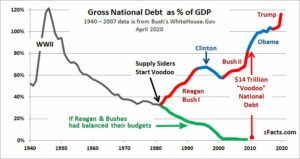

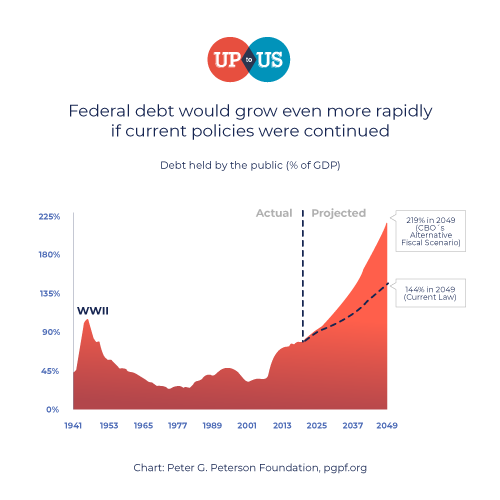

U.S. Public Debt: 1940–Present

Why Does the United States Have Such a Large Debt?

There are several important factors that contribute to the enormous level of national debt that we currently face.

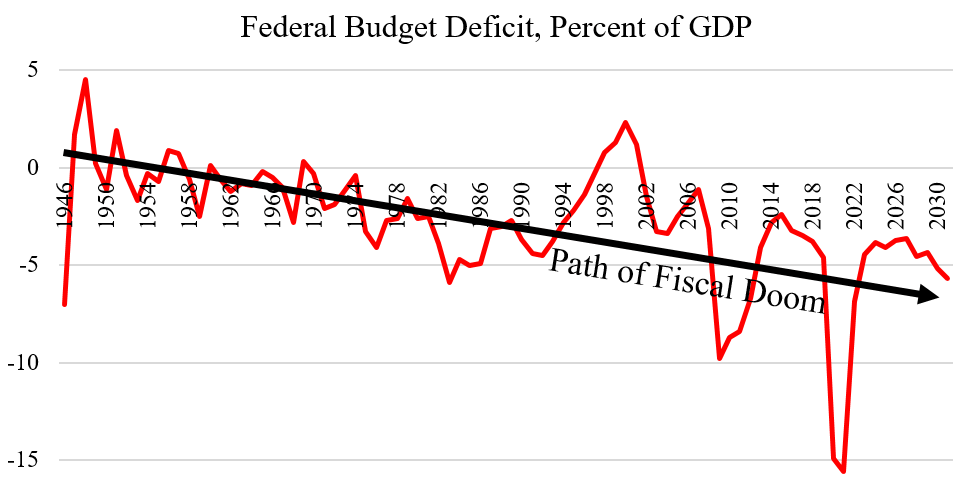

Federal Budget Deficits:

The current president, Barack Obama, is responsible for the greatest deficit to yet. He contributed an additional $8.3 trillion to the debt, representing a 70% increase. This is because of a stimulus package known as the American Recovery and Reinvestment Act (ARRA), which helped put an end to the financial crisis that occurred in 2008. Additionally, he reduced tax rates while raising spending on the military. 3

Even though the national debt clock increased by a greater monetary amount under the Obama administration, it was not the greatest growth by percentage. This distinction is due to former U.S. President Franklin D. Roosevelt. Even though he only added roughly $236.1 billion to his wealth between 1933 and 1945, this represents an increase of approximately 1,048%. 4 He did this in order to combat the Great Depression and have the United States ready to enter World War II at the beginning of the 1940s. He undertook this preparation work.

In terms of dollars contributed, President Donald Trump is the second-largest donor to the national debt. He contributed an additional $7.8 trillion to the total debt. This represented an increase of 39%. Since he took office on January 20, 2021, President Biden has contributed $2.26 trillion to the ever-increasing national debt as of the 1st of February, 2022. This spending is significantly more than that of either President Obama or President Trump.

The Trust Fund for Social Security:

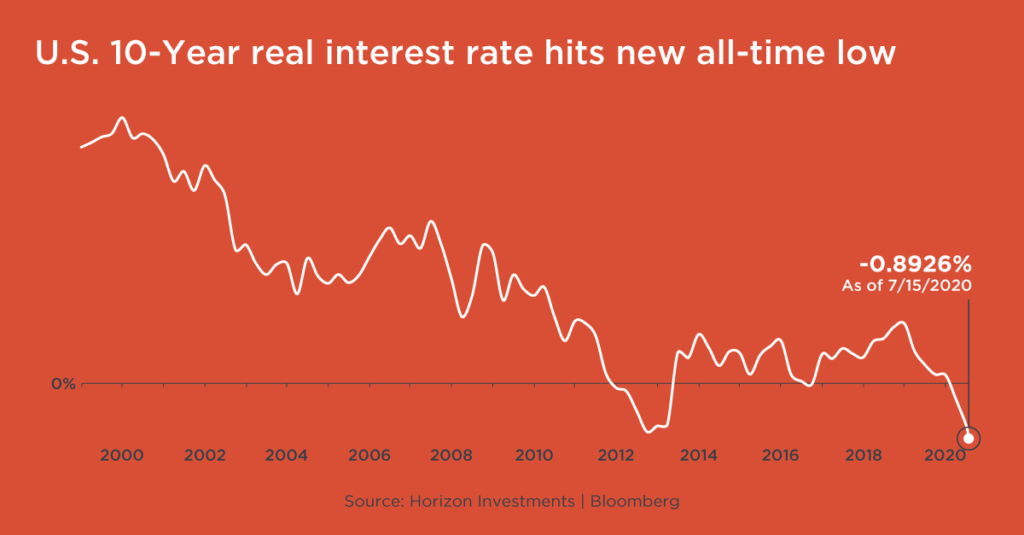

In an ideal world, this money would have been invested so that it would still be accessible when people of that generation reach retirement age. Instead, money from the Fund was “borrowed” by the government so that it could pay for its increased spending. This loan does not accrue interest, hence it helps to keep interest rates on Treasury bonds at a low level, which allows for increased debt financing. However, it will need to be paid back with higher taxes when more people reach retirement age.

Investment From Other Countries:

Historically Low-Interest Rates:

The Debt Ceiling:

Congress lifts the debt ceiling often. Congress has raised the borrowing limit 78 times since 1960, and more are likely. 8 The Bipartisan Budget Act of 2019 postponed the debt limit until July 31, 2021. 9 The debt cap equaled the national debt on August 1, 2021. The fiscal cliff was raised by $2.5 trillion on December 14, 2021, to $31.4 trillion. This was the highest national debt rise.

How the Massive Amount of Debt in the United States Affects the Economy:

This is a more recent phenomenon in the United States, and it is cause for concern. In 1988, the national debt clock was equal to half of what the United States produced that year. Today, it is twice as high. After that point, the United States would be required to make interest payments at a higher rate.

Congress is well aware that a debt crisis is on the horizon. In fewer than 20 years, the Social Security Trust Fund will not have the resources to pay out the retirement benefits that were promised to persons who were born between 1946 and 1964. 14 This could result in greater taxes once the high level of U.S. debt makes it impossible for the country to get additional loans from other nations.

FAQs:

How much debt does the United States currently have?

The national debt of the United States is continuously growing, but it reached a new benchmark of $30 trillion in February 2022.

What exactly is the United States debt clock?

The national debt clock in the United States keeps a running total of how much additional debt the country has racked up. It is not a count in real time; rather, it is an estimate derived from data that is constantly being updated. You can find several versions of the clock online, in addition to the one that is really displayed in New York City.

Which nation has the highest overall level of debt?

With a debt-to-GDP ratio that is greater than 260%, Japan is the developed nation that is the most burdened by debt. The United States of America has an approximate debt-to-GDP ratio of 108 percent.

Final Words:

US debt clock is hidden in a Times Square underpass. It never slows down, month by month, year after year. The national debt clock, created by real estate mogul Seymour Durst in 1989, isn’t the national debt. It’s a portrayal of the national debt, a basic count of the amount of money the federal govt has acquired from the taxpayers and has yet to repay. Who’re most in debt? Japan’s debt-to-GDP ratio is around 260%, making it the most indebted developed nation. US debt-to-GDP is 108%.